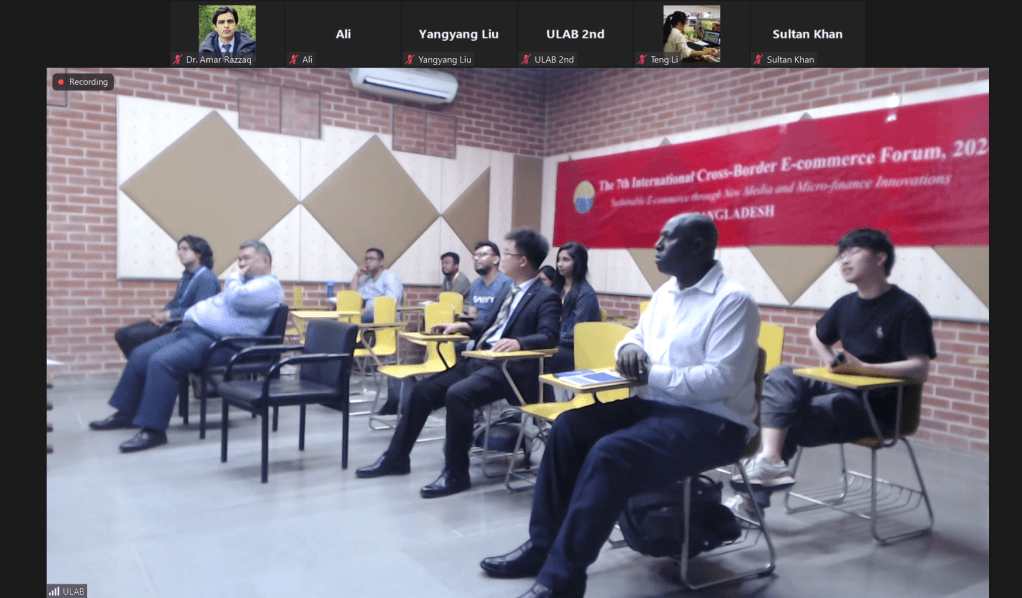

The 7th International Cross-Border E-commerce Forum (CBEC) 2024, co-hosted by University of Liberal Arts Bangladesh (ULAB) and Huazhong Agricultural University, commenced on May 30th, 2024 at the ULAB campus in Dhaka. The forum aimed to promote sustainable micro-finance initiatives, launch the YOU Fund, and strengthen e-commerce cooperation between China and Bangladesh. The event brought together researchers, academics, business professionals, and key stakeholders from China, Bangladesh, and other countries along the Belt and Road Initiative.

Day 1 – 3 (May 28 – 30, 2024): Arrival, Preparation, and Welcome

The Chinese delegation, including Professor Zhou Deyi, Chen Zhilin, Li Gen, and Zhou Zhaowen, arrived in Dhaka on May 28th, 2024. Despite long-term planning and tireless efforts to secure visas, Dr. Amar Razzaq and Saqib Khan were unable to join the forum in person due to visa issues. However, they actively participated in the event through online platforms and contributed to the organization and planning of the forum.

Upon arrival, Chen Zhilin, Li Gen, and Zhou Zhaowen encountered an unexpected challenge at the airport. Due to a language barrier and incomplete documentation, they were stuck at the airport for three hours while attempting to obtain visas on arrival. Despite this setback, the delegation remained in good spirits and looked forward to the upcoming events.

In the evening of May 28th, the Chinese delegation enjoyed a warm welcome and the dinner with Dr. Jude, Dr. Kader, and two other colleagues from ULAB. The dinner provided an opportunity for the participants to get acquainted, discuss the forum’s agenda, and build rapport before the official commencement of the event.

Prof. Geoffrey Gathungu arrived in Dhaka from Kenya in the early hours of May 29 to join the delegation. Then, on the morning of May 29th, the delegation visited the New Market, a local wholesale market in Dhaka. This visit allowed the participants to gain insights into the local economy, observe the bustling trade activities, and understand the potential for cross-border e-commerce in the region. In the afternoon, the delegation had the privilege of meeting with the Vice-Chancellor and the Dean of the Business School at ULAB. These meetings laid the groundwork for further collaboration and strengthened the partnership between Huazhong Agricultural University and ULAB.

The morning of May 30th was dedicated to finalizing the preparations for the forum. Professor Zhou Deyi and the Chinese delegation met with Dr. Kader to discuss the schedule of the meeting and ensure that all necessary arrangements were in place. The afternoon was spent at ULAB, where the team worked diligently to prepare the meeting room and test the audio-visual equipment to guarantee a seamless experience for both in-person and online participants.

Throughout these initial days, the atmosphere was filled with anticipation and enthusiasm for the upcoming forum. The Chinese delegation, along with their Bangladeshi counterparts, worked tirelessly to create an environment conducive to meaningful discussions, knowledge sharing, and collaboration. The stage was set for the 7th International Cross-Border E-commerce Forum to be a resounding success, paving the way for stronger partnerships and innovative solutions in the field of sustainable micro-finance and e-commerce cooperation.

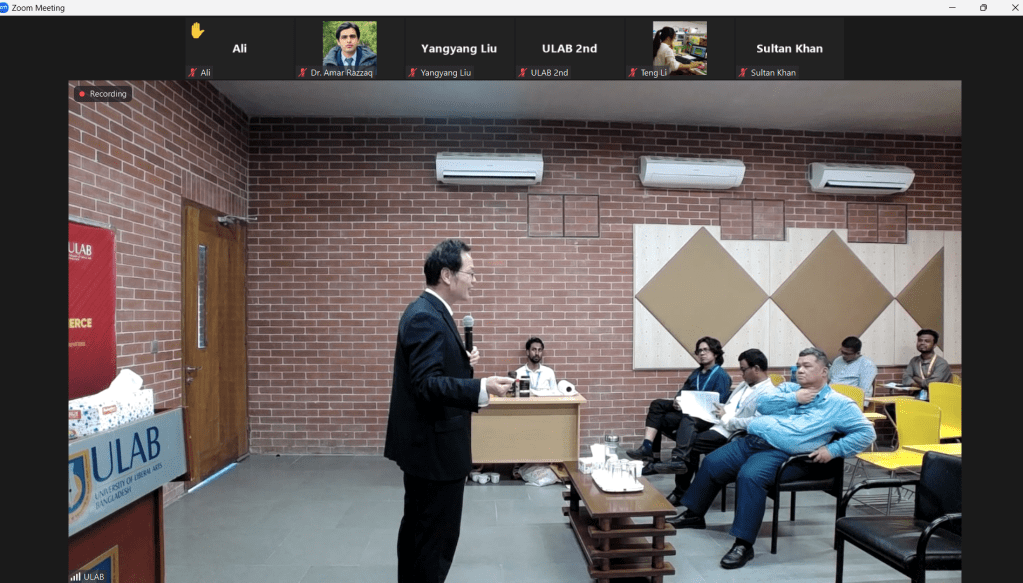

Day 4 (May 31, 2024) – The Formal Forum Sessions at ULAB

Session I: Promoting Sustainable Micro-finance, E-commerce Cooperation, and Communication between China and Bangladesh

Session Chair: Kader Muhammad

Opening Remarks by Professor Li Gucheng

Professor Li Gucheng, Dean of the College of Economics and Management at Huazhong Agricultural University, delivered the opening remarks for the 7th International Cross Border E-commerce Forum. He began by expressing his honor to speak at the event, emphasizing its significance in fostering ongoing collaboration among Belt & Road countries. Professor Li provided a brief history of the forum’s journey, highlighting the various locations where it had been held in previous years, including Pakistan, Bangladesh, and China.

Professor Li then discussed the joint research projects that have emerged from these forums, showcasing the diverse range of initiatives being undertaken. He mentioned the China-Mongolia Cross Border E-commerce Model and Key Technologies project in 2024, the China-Egypt Solar Energy Application Project, the Interest Subsidies on Microfinance and Cross Border E-commerce in Kenya in 2024, and the International Student Summer School Programme in China in 2024. While acknowledging that not all projects have been successful, Professor Li reaffirmed the forum’s commitment to its goals and the importance of perseverance in the face of challenges.

One of the key announcements made by Professor Li was the launch of the You Fund during the forum. He described the You Fund as a small seed fund dedicated to poverty alleviation and environmental protection in rural areas of Belt & Road countries. Professor Li emphasized that the success of the You Fund would depend on the collective efforts of all participants and stakeholders, highlighting the importance of collaboration and shared responsibility.

Professor Li then discussed the immense potential for cooperation between China and Belt & Road countries, citing their unique resources and comparative advantages. He likened cross-border e-commerce to an online Silk Road, connecting China with its partner nations and facilitating the exchange of goods, services, and ideas. Professor Li expressed his hope that the forum would help realize this potential for the benefit of the world and ensure the sustainability of the forum itself.

Stressing the importance of innovation, Professor Li emphasized that cooperation is about creating new value by combining resources in novel ways. He quoted the saying, “A little spark can ignite a great fire,” underlining the transformative power of collaboration and the potential for small initiatives to create significant impact.

Professor Li concluded his remarks by providing a brief introduction to Huazhong Agricultural University, located in Wuhan, central China. He highlighted the university’s 125-year history and its leading role in various agricultural fields, such as rice breeding, rapeseed, oranges, and pigs. Professor Li acknowledged the previous visits of Dr. Jude, Dr. Saiful Islam, Professor Palash, and Professor Geoffrey Gathungu to the university, and extended an open invitation to all forum participants to visit the campus and explore potential avenues for creative and interesting cooperation.

Finally, Professor Li expressed his well wishes for the success of the forum and his appreciation for the friendly relationship between Bangladesh and China. His opening remarks set a positive tone for the event, emphasizing the importance of collaboration, innovation, and shared goals in advancing cross-border e-commerce and sustainable development initiatives among Belt & Road countries.

Professor Li’s opening remarks laid the foundation for a productive and inspiring forum, fostering a sense of unity and purpose among the attendees.

Overview of Rural E-commerce in China and CBEC Initiative by Dr. Amar Razzaq

Dr. Amar Razzaq, Associate Professor at Huanggang Normal University, presented a comprehensive overview of the rural e-commerce landscape in China and the CBEC initiative. He began by highlighting the significant growth of e-commerce in rural areas, with an internet penetration rate of 34% (accounting for 26.7% of total internet users) and rural online retail sales exceeding 143 billion US$ (17.4% of total retail sales). Dr. Razzaq also noted that agricultural products online retail sales reached 30.7 billion US$, accounting for about 18% of total rural retail sales.

Dr. Razzaq then introduced the “Taobao Village” model, a government and Alibaba-backed initiative aimed at promoting e-commerce in rural areas. He explained that a Taobao Village is characterized by residents spontaneously engaging in e-commerce primarily through the Taobao Marketplace, with a total annual e-commerce transaction volume of at least RMB 10 million (~US$ 1.43 million) and at least 10% of village households actively participating in e-commerce or having at least 100 active online shops. Dr. Razzaq emphasized the success of the Taobao Village model in catalyzing industry clusters in rural areas.

Moving on to the history of the CBEC initiative, Dr. Razzaq provided a detailed timeline of events and activities from 2016 to the present. He discussed the various visits, training workshops, and research conducted by the CBEC team, including trips to Alibaba Group in Hangzhou, investigations into how e-commerce helps alleviate poverty in rural areas of Gansu Province, and understanding the e-commerce scene in Wuhan.

Dr. Razzaq also highlighted the establishment of the E-commerce Research Institute at HZAU in March 2019 and the launch of the CBEC old website (www.brcbec.top; not functional anymore). He shared his experiences visiting various Taobao Villages in Hangzhou, Shiyan, Zhijiang, Luoyang City (Henan Province), and Huimin City (Shandong Province), as well as attending the 7th China Taobao Village Forum in Shandong in August 2019.

Turning his attention to the international collaborations fostered by the CBEC initiative, Dr. Razzaq discussed the Second International CBEC Forum held in Pakistan in 2019. He outlined the various activities conducted during the visit to Gilgit, Pakistan, including stakeholder meetings with government departments and NGOs, interactions with Karakoram University students for e-commerce training, and the identification of potential sites for a Taobao Village and a summer camp for e-commerce entrepreneurship. Dr. Razzaq also mentioned the establishment of the Sino-Pak CBEC Association in December 2019 and the meetings held with the Pakistan Agricultural Research Council (PARC) to promote cross-border e-commerce cooperation.

Dr. Razzaq then discussed the subsequent CBEC forums held in Bangladesh (2020), China (2021 and 2022), and the 6th CBEC Forum in 2023, which took place in Longnag, Kashgar, and Gilgit, involving collaboration between Huazhong Agricultural University, Kashgar Regional Bureau of Commerce, Longnan E-Commerce Development Bureau, and Karakoram International University.

Looking ahead, Dr. Razzaq announced the upcoming 8th International CBEC Forum to be held in Mongolia in 2025, in collaboration with the Mongolia Life Sciences University. He also introduced the International Cross Border Ecommerce Summer School Program, scheduled for August 5th to August 22nd in Xinjiang, China, and encouraged participants to submit their applications.

Dr. Razzaq’s presentation provided a thorough and engaging overview of the rural e-commerce landscape in China and the extensive work carried out by the CBEC initiative in promoting cross-border e-commerce cooperation, research, and training. His insights highlighted the significant potential for e-commerce to drive economic growth and alleviate poverty in rural areas, while also emphasizing the importance of international collaboration and knowledge sharing in achieving these goals.

Kenyan Micro-finance Project Progress Report by Geoffrey K. Gathungu

Geoffrey K. Gathungu, Associate Professor at Chuka University in Kenya, presented a detailed account of the micro-finance initiative in Kenya. He began by discussing the importance of agriculture in Kenya as a key driver of poverty alleviation, employment, income generation, GDP growth, foreign exchange earnings, and food security. However, he noted that agricultural productivity is lagging behind due to poor financing, especially for small-scale farmers.

Professor Gathungu highlighted the critical role of microfinance institutions in enhancing the production and productivity of smallholder farmers by providing them with the necessary financial resources. He explained how microfinance can be used to provide small-scale and low-cost agricultural machines, acquire agricultural inputs like seeds and fertilizers, and facilitate post-harvest value addition.

Despite the potential benefits of microfinance, Professor Gathungu noted that the adoption and utilization of microfinance credit in smallholder farming systems fall short due to challenges such as the administrative complexity of small loans and the lack of necessary collateral. He emphasized that smallholder farmers are crucial contributors to agricultural and economic development in developing countries, making their access to credit a top priority.

Professor Gathungu then provided an overview of the Kenyan Micro-finance project, which started in August 2013 in the Kimandi village of Gatanga District, Murang’a County. The project initially lent USD 800 to two farmers for raising rabbits and making charcoal. In December 2014, an additional USD 1000 was released to the Broad Vision Group, led by Joseph Maina Gitao, and distributed among 10 members of the group as a revolving fund.

The projects implemented by the group included seedlings (avocado, ribena, cypress, cabbages) and consumables like fertilizers, insecticides, polythene, manure, and labor, as well as hotel, courgette farming, bull rearing, and poultry (hen) businesses. However, the farmers faced challenges such as the death of chickens due to diseases and pests, drought affecting crop growth, and difficulty in buying chicken feed.

Despite these challenges, some farmers reported profits, such as the bull project, which generated KSh 57,600 used to rebuild a cow shed, construct a feeding trough, and a table for cutting napier grass. The hotel business owner reported that they would repay the debt within 1 year and 3 months while maintaining a stable business and paying two assistants.

Professor Gathungu also shared his personal experience with microfinance, both as a researcher at the Kenya Agricultural Research Institute (KARI) and as a lecturer at Chuka University. He discussed the establishment of the Plant Science Investment group at Chuka University, which provided loans to members and non-members at different interest rates.

In 2018, Professor Gathungu attended the 1st Cross Border E-Commerce Forum at Huazhong Agricultural University in Wuhan, China, where discussions were held on visiting the Broad Vision SHG in Kimandi, Gatanga County, to address the issues of refunding and circulation of funds. Chuka University visited the group in 2022, provided training on available opportunities, and conducted a survey on the effect of microfinance on the adoption of small farm equipment.

Following consultations with Professor Zhou Deyi, a funding of 50,000 CNY (approximately KSh 952,970) was provided in April 2022. A portion of the funds (KSh 350,000) was used for logistical support in conducting surveys in Broad Vision SHG and four other farmer groups in Chuka, Tharaka Nithi County. The remaining funds (KSh 600,000) were used for lending to small-scale farmers in the form of equipment/inputs rather than cash loans.

Professor Gathungu shared the findings of a study conducted in Gatanga Muranga County and Chuka Tharaka Nithi County, which assessed the role of microfinance credit access and uptake in relation to the adoption of small agricultural machinery. The study found that factors such as farming experience, gender of the household head, number of enterprises, yield per unit area, years of schooling, household size, organization membership, access to extension services, and collateral availability significantly influenced microfinance credit uptake.

The Chuka University microfinance project has opened a joint account managed by three researchers to ensure accountability and transparency. As of October 2023, the project has loaned funds to three business people: a groceries saleslady, a foodstuff shopkeeper, and an electronic shop owner. Loans are to be repaid within 5 months with interest rates ranging from 2.75-5% per month.

Professor Gathungu concluded his presentation by sharing lessons learned from the microfinance project, including the need to work with farmers, the importance of collaboration at all levels, the effectiveness of lending inputs instead of cash, the significance of conservation of nature, the role of culture in microfinance uptake, the need for government involvement in agricultural policy, the challenges of operating in rural areas, the importance of flexible repayment schedules, and the benefits of pairing microfinance credit with agriculture trainings.

Pakistani Micro-finance Project Progress Report by Saqib Khan

Saqib Khan, a PhD candidate at Huazhong University of Science and Technology and the key member of the CBEC team, presented the progress report on the Pakistani micro-finance project, focusing on the Cattle Fattening Project (In fact, Professor Zhou presented on behalf of Saqib as he had to deal with something else at that time). The project aims to empower small-scale farmers in Pakistan by providing them with microfinancing through the YOU Fund to purchase cattle for fattening ahead of the Eid al Adha (Festival of Sacrifice).

The project’s financial structure allocates 50% of the profit to the participating farmer, reinvests 30% to purchase more cattle and finance additional farmers, and uses 20% to cover administration costs. A total of 962,500 PKR (approximately 25,000 Chinese Yuan) was allocated for the project, with 59% of the funds (567,800 PKR) utilized so far.

In the current year, the project selected two farmers, Imran and Imam Bakhsh, and provided each with financing to purchase two bulls. The project manager ensures that the animals are properly fed, arranges timely vaccinations, and conducts regular visits. The farmers are responsible for feeding and caring for the cattle for 6-9 months before selling them at a premium price before the festival.

Mr. Khan reported that the project plans to fully utilize the available funds after the festival and finance more farmers, with an expected fund availability of 1,120,000 PKR, sufficient to buy 10 cattle and finance 5 farmers.

Consumer Attention and Market Concentration in E-Commerce by Teng Li, Shaoni Wang, Amar Razzaq, and Deyi Zhou

Teng Li, a double degree PhD candidate at Huazhong Agricultural University and University of Groningen, Netherlands, presented a study on consumer attention and market concentration in e-commerce using an agent-based modeling approach. The study examined the role of consumer behavior and social influence in driving market concentration, where a small number of firms dominate the market. The presentation included the concepts of attention overload, the impact of social influence on consumer decisions, and strategies for e-commerce businesses to navigate this environment. Teng Li explained that consumers have a limited ability to process all available information about products and sellers, and their decisions are often influenced by recommendations from friends, family, and social media. As a result, a small number of firms with strong brand recognition and online presence tend to dominate the market. Teng Li suggested strategies for e-commerce businesses to navigate this challenging environment, including building strong brands, leveraging social media effectively, and focusing on providing high-quality products and services to gain customer trust and loyalty.

Group Photo and Lunch Break

Following the conclusion of the first session, the participants gathered outside the conference hall for a group photograph. After the group photo, the participants proceeded to enjoy a well-deserved lunch break, providing an opportunity for informal networking and further discussions.

Session II: Advancing Sustainable E-commerce through New Media and Micro-finance Innovations

Session Chair: Dr. Amar Razzaq

Welcome Speech by Prof. Jude Williams

Prof. Jude Williams, Pro-Vice Chancellor of ULAB, warmly welcomed the participants and emphasized ULAB’s commitment to promoting sustainable practices. He began by sharing his personal experiences with Huazhong Agricultural University, having visited the institution twice, first in 2007 for a month-long faculty exchange and then in the previous year to present a paper on rice farming. Prof. Williams highlighted the renowned status of Huazhong Agricultural University as one of the top agricultural universities in China, noting its expansive campus and impressive agricultural initiatives, such as producing their own high-quality tea.

Prof. Williams then discussed the importance of the partnership between Huazhong Agricultural University and ULAB, as it combines the strengths of both institutions in agriculture, agricultural economics, and communication. He emphasized China’s focus on developing e-commerce capabilities to sell its products globally, particularly through online platforms, as part of the Belt and Road Initiative. Prof. Williams noted that Bangladesh is one of the partners in this initiative, along with other countries such as Kenya, Pakistan, and Kazakhstan.

Stressing the importance of effective communication in the success of e-commerce, Prof. Williams highlighted ULAB’s specialization in communication and media studies. He emphasized the need for China to convince people of the quality of their products to drive sales, and how ULAB’s expertise in this area can contribute to the success of cross-border e-commerce initiatives. Prof. Williams also announced the upcoming summer school on cross-border e-commerce organized by Huazhong Agricultural University in August, which will focus on communication strategies, content creation, and the use of mobile phones and e-commerce platforms for selling products.

Prof. Williams then discussed the theme of the forum, “Sustainable E-commerce through New Media and Microfinance Innovations,” discussing the need to address the environmental and social impacts of the rapidly growing e-commerce sector. He highlighted the role of new media in promoting sustainability by increasing consumer education and awareness, making companies more transparent and accountable, and fostering community building and support. Prof. Williams cited the example of ULAB’s own organic tea brand, Kashi and Kasity, which demonstrates transparency in its production processes and community engagement initiatives.

Moving on to the topic of microfinance, Prof. Williams emphasized its significance in enabling small businesses to adopt sustainable practices and fostering economic diversity and resilience. He acknowledged Bangladesh’s prominent role in the microfinance sector, with the pioneering work of Grameen Bank and Nobel Prize laureate Muhammad Yunus. Prof. Williams noted that the majority of businesses in Bangladesh are small and medium-scale enterprises, and microfinance plays a crucial role in supporting their growth and the overall economy. He also highlighted the importance of microfinance in promoting inclusion and equity, empowering marginalized groups such as women and rural entrepreneurs to participate in the digital economy.

Finally, Prof. Williams reaffirmed ULAB’s commitment to the principles of sustainability, innovation, and social responsibility, aligning with the values of a liberal arts education. He envisioned a future where the strengths of new media and microfinance are integrated to drive sustainable e-commerce practices, with informed consumer choices, thriving small businesses, and impactful online communities. Prof. Williams called for collaboration among ULAB, Huazhong Agricultural University, and other concerned universities to work towards a more inclusive, equitable, and environmentally friendly digital marketplace.

Prof. Williams’ welcome speech set the stage for the forum by highlighting the importance of sustainable e-commerce, the role of new media and microfinance in achieving this goal, and the significance of collaboration between institutions with diverse expertise. His insights emphasized the need for a holistic approach to e-commerce that prioritizes environmental and social responsibility while driving economic growth.

Bangladesh Micro-finance Project Progress Report by Kader Muhammad

Dr. Kader Muhammad, a faculty member from the Department of Media Studies and Journalism at ULAB, presented the progress report on the micro-finance project in Bangladesh, which is being implemented in conjunction with the Community Digital Storytelling (CDS) project. He began by providing an overview of the CDS project, explaining that it involves visiting remote areas in Bangladesh and training local community members in digital storytelling techniques using cameras, mobile phones, and other available technology. The aim of the project is to empower these individuals to tell their own stories, express their needs, and share their experiences in their own way.

Dr. Kader emphasized that the CDS project focuses on improving the critical thinking, communication skills, and digital literacy of the participants. He then shared an example of a recent project conducted with the Santal community, one of the largest ethnic communities in Bangladesh, located in the Peerganj area. Dr. Kader and his co-researcher, Dr. Jude, along with their team, visited the community and engaged with the local people, teaching them digital skills and storytelling techniques. The participants included students, working individuals, female football players, and community members who had to discontinue their education due to financial constraints.

Dr. Kader then discussed how the micro-finance component was integrated into the CDS project when Professor Zhou Da-Yi introduced the idea. He presented the case of Chanduna, a college student from the Santal community who had to discontinue her education due to financial difficulties and was working as a laborer on other people’s farms. Through the micro-finance project, Dr. Kader and his team managed to purchase four cows for Chandona. They also trained her in digital storytelling techniques, which she is now applying within her community.

Dr. Kader acknowledged that the micro-finance project is still in its early stages and that they expect to see results within a year. He highlighted the unique aspect of combining media studies and journalism with micro-finance, empowering the ethnic community members not only with storytelling skills but also with financial support.

During the question and answer session, Dr. Amar Razzaq inquired about the selection process for the beneficiaries of the micro-finance project. Dr. Kader clarified that they choose beneficiaries from the communities they work with in the CDS project, ensuring that the support is directed towards those who need it the most.

Dr. Amar also suggested that Professor Zhou Deyi and Professor Geoffrey from Kenya could have a meeting to exchange ideas and learn from each other’s experiences in implementing micro-finance projects, as both Bangladesh and Kenya have significant expertise in this area. He emphasized the importance of collaboration and knowledge sharing, as all the participants are in the initial stages of the YOU Fund micro-finance initiative.

Dr. Kader concluded his presentation by reiterating that the micro-finance project is a work in progress and that they plan to create a documentary showcasing the impact of the initiative once it is completed. He expressed his hope that the combination of digital storytelling and micro-finance will lead to positive progress within the Santal community.

Dr. Kader’s presentation highlighted the innovative approach of integrating media studies and micro-finance to empower marginalized communities in Bangladesh. By equipping participants with both digital storytelling skills and financial support, the project aims to create a holistic and sustainable model for community development. The progress report underscored the potential for collaboration and knowledge exchange among different countries and institutions involved in micro-finance initiatives, fostering a global network of support for small-scale farmers and entrepreneurs.

Launching Ceremony of the YOU Fund by Zhou Deyi

Professor Zhou Deyi, founder and CEO of the YOU Fund, delivered an emotionally charged speech during the launching ceremony. He began by posing two profound questions: “Why am I here?” and “What is a good life?” Professor Zhou acknowledged that the answers to these questions might vary among individuals, but he shared his personal perspective and the driving forces behind the creation of the YOU Fund.

From a social standpoint, Professor Zhou emphasized the significance of China’s economic rise as the biggest event of the century. He highlighted China’s massive population, which surpasses the combined populations of Europe, Japan, America, and Korea, and the country’s remarkable achievement of rapid industrialization within a mere 30 years. Professor Zhou noted that China’s manufacturing sector now equals the combined capacity of Japan, Germany, and America, generating substantial income for the Chinese people and providing trade opportunities for developing countries that lack strong manufacturing capabilities.

Professor Zhou stressed the importance of e-commerce as an efficient means of trade, leveraging IT technology to reduce transaction costs. He observed that in China, a significant portion of the younger generation’s expenditure comes from online purchases, as people have grown accustomed to the convenience of buying online. Professor Zhou predicted that e-commerce would become a transformative force in the global economic landscape.

However, Professor Zhou also emphasized that China cannot solely focus on earning money from the rest of the world; it must also give back. While acknowledging the Chinese government’s efforts in providing scholarships and donations to other countries, particularly in Africa, he expressed his belief that these initiatives are not always efficient. This realization led him to launch the YOU Fund as a personal initiative, funded from his own pocket, driven by the conviction that it is the right thing to do.

Professor Zhou then explained the personal motivation behind the YOU Fund, sharing a deeply emotional account of his grandfather, Yu Chengyou. With tears in his eyes, Professor Zhou recounted how his grandfather, a hardworking and honest farmer, had suffered greatly throughout his life and had passed away without receiving proper care in his old age. Professor Zhou’s voice trembled as he described the profound impact his grandfather had on shaping his personality and worldview, instilling in him a deep appreciation for the qualities of honesty and hard work.

Composing himself, Professor Zhou explained that the YOU Fund was established to honor his grandfather’s memory and to promote the values he embodied. The fund aims to provide microfinance support to small farmers in China, Kenya, Pakistan, and Bangladesh, with an initial seed fund provided by Professor Zhou himself. He expressed his hope that the fund would grow over time, attracting new donations from individuals who share a compassion for all species on Earth.

Professor Zhou emphasized the importance of trust and minimal management costs in the operation of the YOU Fund. He assured the audience that local teams in each country would have full autonomy and decision-making authority in loan management, encouraging them to grow as independent organizations and share their experiences with one another.

Professor Zhou then announced that Dr. Amar Razzaq, an Associate Professor at Huanggang Normal University and a close friend of his, would serve as the Program Manager of the YOU Fund. He explained that Dr. Amar Razzaq’s role would involve tracking the progress of the fund, keeping records, and performing program oversight. Professor Zhou expressed his confidence in Dr. Amar Razzaq’s abilities, citing his expertise in writing and his position as the Editor-in-Chief of the Journal of Entrepreneurship for Sustainability.

Professor Zhou acknowledged his own busy schedule, which includes managing various aspects of the fund and conducting educational programs at his farm, such as the summer school. He emphasized that appointing Dr. Amar Razzaq as the Program Manager would ensure the efficient management of the YOU Fund and allow for the effective communication of its progress and impact through regular reports and publications in the journal.

Displaying the proposed logos for the YOU Fund, Professor Zhou explained the significance of the Chinese character “友” (you), which represents friendship and is also a homophone for his grandfather’s name. He settled on a logo that resembles a farmer, symbolizing the fund’s commitment to supporting rural communities.

Professor Zhou concluded his speech by reaffirming his purpose for attending the forum: to promote trade through e-commerce and to advance microfinance initiatives for poverty alleviation and environmental protection. He expressed his belief that the solution for a good life should extend beyond individual or national prosperity; it should encompass the well-being of all species. With a final, emotional appeal, Professor Zhou called upon the audience to join him in this endeavor, working together to create a better world for all.

The launching ceremony of the YOU Fund served as a powerful testament to Professor Zhou’s personal dedication and the transformative potential of microfinance in uplifting communities and promoting sustainable development. His heartfelt speech left a lasting impact on the audience, inspiring them to embrace the values of compassion, generosity, and shared responsibility in the pursuit of a good life for all.

Certificate Awarding Ceremony for Microfinance Beneficiaries

The certificate awarding ceremony was a significant event during the 7th International Cross-Border E-commerce Forum, as it recognized and celebrated the beneficiaries of the YOU Fund (previously known under a different name) since its inception in 2013. The ceremony aimed to commemorate the achievements of the beneficiaries, keep records of their progress, and encourage them to continue their efforts in promoting sustainable development through micro-finance initiatives.

In a unique and environmentally conscious approach, Professor Zhou Deyi, the founder of the YOU Fund, decided to award e-certificates to the beneficiaries, emphasizing the importance of protecting the environment by reducing paper waste. This digital approach to the certificate awarding ceremony aligned with Professor Zhou’s philosophy of promoting sustainability and minimizing the environmental impact of human activities.

Dr. Amar Razzaq, the newly announced Program Manager of the YOU Fund, conducted the ceremony, inviting representatives from each country to receive the e-certificates on behalf of the beneficiaries. Professor Geoffrey K. Gathungu from Chuka University in Kenya received the e-certificates on behalf of the Kenyan microfinance beneficiaries, who have been actively involved in various agricultural projects and have shown remarkable progress in improving their livelihoods through the support of the YOU Fund.

Dr. Kader Muhammad from the University of Liberal Arts Bangladesh (ULAB) received the e-certificates on behalf of the Bangladeshi microfinance beneficiaries. These beneficiaries, primarily from the Santal community, have been participating in the Community Digital Storytelling project and have recently begun to benefit from the integration of micro-finance initiatives, which have enabled them to purchase livestock and improve their economic conditions.

Chen Zhilin, a representative from Pakistan, received the e-certificates on behalf of the Pakistani microfinance beneficiaries. The Pakistani beneficiaries have been involved in the Cattle Fattening Project, where they have received financing through the YOU Fund to purchase cattle for fattening and selling them at a premium price during the Eid al Adha festival.

As Professor Zhou Deyi awarded the e-certificates to the representatives, he expressed his gratitude and admiration for the hard work and dedication of the beneficiaries. He emphasized that the success of the YOU Fund relies on the collective efforts of the beneficiaries, the local teams managing the funds, and the support of the international community. Professor Zhou also encouraged the beneficiaries to continue their efforts in promoting sustainable development and to share their experiences and knowledge with others in their communities.

The e-certificates served not only as a recognition of the beneficiaries’ achievements but also as a symbol of the YOU Fund’s commitment to promoting sustainable development through micro-finance initiatives. The digital format of the certificates showcased the fund’s dedication to embracing technology and innovation in its pursuit of creating a more equitable and environmentally friendly world.

The certificate awarding ceremony was a heartwarming and inspiring moment during the forum, as it highlighted the tangible impact of the YOU Fund on the lives of small-scale farmers and entrepreneurs in Kenya, Bangladesh, and Pakistan. It also served as a reminder of the importance of international cooperation and the power of micro-finance in driving positive change and empowering marginalized communities.

As the ceremony concluded, the participants applauded the efforts of the beneficiaries and the representatives who received the e-certificates on their behalf. The digital certificates will serve as a lasting reminder of the achievements and progress made through the YOU Fund, inspiring future generations to continue the work of promoting sustainable development and creating a better world for all.

Pictures and Videos Sharing Presentation

Prof. Zhou Deyi led a visual journey through the YOU Fund’s projects, showcasing photos and videos documenting the fund’s initiatives in Kenya, Pakistan, and Bangladesh. He provided context for each visual, explaining the challenges faced by the beneficiaries, the solutions provided by the YOU Fund, and the positive outcomes observed. The presentation included videos and pictures of Hu Xujie in Senegal, Lacina in Uganda, Ligen’s story and group trip in Mongolia, Zhou Deyi, Ligen, Chen Zhilin, and Xiaowei visiting Sri Lanka, and a micro-finance workshop in Kenya. In addition, pictures from the 6th CBEC forum in Longnan, Kashgar, and Gilgit were also shown. Finally, the video sharing ended with Prof. Zhou showing the pictures and videos from the recently concluded Mongolian trip of the team. The visual presentation added a compelling human element to the discussion, demonstrating the real impact of micro-finance initiatives on the lives of small-scale farmers and entrepreneurs.

Discussion on Sustainability of YOU Fund

The session concluded with an engaging discussion on the sustainability of the YOU Fund and other micro-finance initiatives. Dr. Amar Razzaq moderated the discussion and invited Professor Zhou Deyi to share his thoughts on how to sustain the YOU Fund over the years, find more donors, and improve performance and the disbursement process.

Professor Zhou acknowledged that the YOU Fund is at a crossroads, with the potential to either grow bigger or diminish and finish once the initial funds are exhausted. He emphasized the importance of having a solid mechanism and good performance to convince potential donors to support the mission. Professor Zhou likened this challenge to the “chicken and egg” dilemma, where it is unclear whether a strong mechanism and good performance should come first to attract more funds, or if more funds are needed to establish a robust system.

Professor Zhou stressed that the managers of the YOU Fund should be passionate entrepreneurs who genuinely love and enjoy the work itself, rather than being solely motivated by financial gain. He believed that this passion and volunteer spirit are preconditions for sustainability, especially in the early stages of the initiative.

Reflecting on his personal journey, Professor Zhou shared his thoughts on the meaning of life and the pursuit of a good life. He expressed his belief that one should strive to have a positive impact on the world, even after their life is over. To simplify the process, Professor Zhou suggested setting milestones for each year, such as the number of beneficiaries and the amount of funding required. He proposed a goal of supporting 10 beneficiaries per year in each country, resulting in 60 cases across three countries within three years, which would provide sufficient samples for a documentary film to showcase the impact and attract more funding.

Professor Zhou emphasized the importance of combining micro-finance with e-commerce to find a sustainable way forward. He invited other participants to share their thoughts on the sustainability of micro-finance initiatives.

Professor Geoffrey from Kenya contributed to the discussion by sharing the success story of Equity Bank, which started from a village and has now expanded to multiple countries. He emphasized that the sustainability of micro-finance does not solely depend on the amount of money available but on the management and approach taken. Professor Geoffrey suggested conducting studies to understand the farmers being supported, providing training alongside financial assistance, and focusing on unexploited business opportunities that align with the farmers’ interests.

Professor Geoffrey stressed the importance of walking alongside the farmers, learning from them, and ensuring that both parties are moving in the same direction to increase the probability of success. He advocated for a slow and steady approach, taking the time to understand the farmers and building a strong relationship before expanding the initiative.

A student, Mohammed Nabil Islam, raised the idea of promoting sustainable, climate-friendly products in Bangladesh, such as jute products, which have been overlooked in recent years. He suggested that micro-finance could be used to support areas that have been producing these products for many years, enabling them to increase production and contribute to a more sustainable future. Mohammed Nabil Islam also inquired about the eligibility criteria and details of the summer school program.

Professor Geoffrey responded by highlighting the potential of combining micro-finance with e-commerce to help farmers access markets beyond their local communities. He shared an example of a student who successfully established a bulking store for green gram and sorghum, finding a market in the Middle East through e-commerce. Professor Geoffrey emphasized that the combination of e-commerce and micro-finance could significantly contribute to the sustainability of these initiatives.

Dr. Amar Razzaq addressed Mohammed Nabil Islam’s question about the summer school program, confirming that all participants in the forum were eligible to apply. He shared the application requirements, which included submitting personal information, prior experience, and a short business plan or idea. Dr. Amar Razzaq mentioned that the application deadline was June 25th, with results to be announced on July 10th, and the summer school program scheduled from August 5th to August 27th.

Dr. Ali Abderehman from Egypt, an alumnus of Huazhong Agricultural University, contributed to the discussion by suggesting two key points for ensuring the sustainability of micro-finance and cross-border e-commerce initiatives. Firstly, he proposed establishing cooperative working relationships with local partnerships in different countries to create added value, which could be partially allocated to support the sustainability of the business. Secondly, Dr. Ali recommended collaborating with international projects and institutions, such as the Food and Agriculture Organization (FAO), to secure additional funding and resources for the continuation of the work.

Professor Zhou appreciated Dr. Ali’s valuable suggestions and requested that he send his ideas to Dr. Amar Razzaq for inclusion in their records.

The discussion on the sustainability of the YOU Fund and micro-finance initiatives provided valuable insights and suggestions from various participants. The key takeaways included the importance of passion and entrepreneurial spirit among the managers, setting clear milestones and goals, combining micro-finance with e-commerce, conducting thorough studies to understand the farmers, providing training alongside financial support, focusing on unexploited business opportunities, collaborating with local partnerships and international institutions, and adopting a slow and steady approach to build strong relationships with the beneficiaries.

The session concluded with a shared commitment to ensuring the sustainability of the YOU Fund and other micro-finance initiatives, recognizing the potential for these projects to create a lasting, positive impact on the lives of small-scale farmers and entrepreneurs in developing countries.

Conclusion

The 7th International Cross-Border E-commerce Forum provided a platform for academics, researchers, and practitioners from various countries to discuss the challenges and opportunities in promoting sustainable micro-finance and e-commerce cooperation. The forum highlighted the significance of the YOU Fund, a groundbreaking micro-finance initiative aimed at supporting small-scale farmers and entrepreneurs in developing countries, particularly along the Belt and Road.

The presentations and discussions throughout the two-day event emphasized the importance of collaboration, knowledge sharing, and innovative approaches in addressing the specific challenges faced by small-scale farmers and entrepreneurs in Kenya, Pakistan, Bangladesh, and other participating countries. The forum showcased the potential of combining micro-finance with e-commerce to create sustainable and inclusive business models that empower marginalized communities and contribute to poverty alleviation and environmental protection.

The launching of the YOU Fund marked a significant milestone in the forum’s commitment to promoting sustainable micro-finance initiatives. Professor Zhou Deyi’s emotional and inspiring speech about the personal motivation behind the fund’s creation left a lasting impact on the audience, urging them to embrace the values of compassion, generosity, and shared responsibility in the pursuit of a better world for all.

The progress reports from Kenya, Pakistan, and Bangladesh demonstrated the tangible impacts of the micro-finance projects on the lives of small-scale farmers and entrepreneurs, while also highlighting the challenges and lessons learned in the process. The discussions on the sustainability of the YOU Fund and other micro-finance initiatives provided valuable insights and suggestions, emphasizing the importance of passion, entrepreneurial spirit, clear goal-setting, collaboration, and a holistic approach to supporting beneficiaries.

The forum also underscored the significance of international cooperation and knowledge exchange in advancing sustainable micro-finance and e-commerce initiatives. The presence of participants from various countries, including China, Bangladesh, Pakistan, Kenya, and Egypt, showcased the potential for cross-border collaboration in addressing shared challenges and creating new opportunities for small-scale farmers and entrepreneurs.

Moreover, the forum highlighted the role of academia in driving innovation and research in the fields of micro-finance and e-commerce. The presentations on consumer attention and market concentration in e-commerce, as well as the discussions on the integration of media studies and micro-finance, demonstrated the potential for interdisciplinary approaches in creating sustainable and impactful solutions.

The 7th International Cross-Border E-commerce Forum served as a testament to the power of collaboration, innovation, and shared vision in promoting sustainable development and empowering marginalized communities. The insights, experiences, and commitments shared during the forum will undoubtedly inspire further action and cooperation among the participants and their respective institutions, contributing to the creation of a more inclusive, equitable, and sustainable global economy.

As the forum concluded, participants left with a renewed sense of purpose and a strengthened resolve to continue their efforts in advancing sustainable micro-finance and e-commerce initiatives. The connections forged, knowledge exchanged, and inspiration gained during the two-day event will serve as a foundation for future collaborations and innovations in this critical field.

The 7th International Cross-Border E-commerce Forum not only celebrated the progress made thus far but also set the stage for a promising future, where the power of micro-finance, e-commerce, and international cooperation can be harnessed to drive positive change and create a better world for all. As the participants return to their respective countries and institutions, they carry with them the spirit of the forum and the determination to translate the insights and commitments into tangible actions that will benefit small-scale farmers, entrepreneurs, and communities across the globe.

Leave a comment