Theme: Promoting Sustainable Micro-finance, E-commerce Cooperation, and Communication between China and Bangladesh

Venue: Dhaka and Mymensingh, Bangladesh

The hosting of the 7th CBEC forum by University of Liberal Arts and Bangladesh Agricultural University from 29th May to 8th June, 2024 concluded successfully.

Report by Geofrey K. Gathungu, Zhou Deyi, Chen Zhilin, Li Gen and Zhou Zhaowen

Activities at University of Liberal Arts of Bangladesh

Day 1 to Day 4 (29th to 31st May, 2024)

The team of researchers consisting of Professor Zhou Deyi, of Huazhong Agricultural University, China and his assistants Mr. Chen Zhilin, Li Gen and Zhou Zhaowen and Professor Geofrey Gathungu, of Chuka University, Kenya arrived in Nandini Hotel on 28th and 29th May 2024 respectively and started preparations for the 7th CBEC forum and University of Liberal Arts of Bangladesh (ULAB) on the afternoon of 29th May. There was a campus tour to the media studies facilities and the library and the climax was a visit to Prof. Jude William Genilo the Pro-Vice-Chancellor of ULAB. Prof Jude then took the delegation from China and Chuka University to meet the Vice-Chancellor Prof. Imran Rahman. The team deliberated on how e-commerce and microfinance can be integrated to support small holder farmers. There were also insights into areas of collaboration.the Vice Chancellor welcomed the researchers and emphasized that ULAB supports the hosting of the 7th CBEC forum. On 30th may, the main activity was visiting the ULAB town campus and later in the afternoon fixed the 7th CBEC forum in the conference room. A lot of support was received from the ULAB staff members to ensure everything was geared towards successful forum.

0n 31st May the CBEC forum was held with both physical and online attendance. The theme of the forum was “Sustainable E-commerce through New Media and Microfinance Innovations” There was many staff and postgraduate students from ULAB who attended the conference physically led by Prof. Jude who gave the opening remarks. Other opening remarks were also given by Prof. Li Gucheng, the Dean, College of Economics and Management at Huazhong Agricultural University. The presentations given included: Overview of the Rural E-commerce in China, CBEC Initiative, Achievements, and Past Forums by Prof. Amar Razzaq; Kenyan micro-finance project progress by Prof. Geofrey K. Gathungu; Pakistan micro-finance project progress by Prof. Deyi on behalf of Dr. Saqib Khan; Consumer Attention and Market Concentration in E-Commerce by Teng Li, Shaoni Wang, Amar Razzaq, and Deyi Zhou, Bangladesh micro-finance project progress by Dr. Kader Muhammad, and the day was crowned by Launching ceremony of the YOU Fund by Prof. Zhou Deyi, After all the presentations there was an open discussion on the sustainability of microfinance projects in Pakistan, Bangladesh and Kenya who have already received the seed money. It was noted that there is need to combine farmer training with microfinance and also embrace e-commerce to benefit from products that may be of importance in these countries and are cheaply available in China (detailed report of presentations done by Prof. Amar Razzaq can be obtained from CBEC website at Full Report of the 7th CBEC Forum Day 1 – 4.

Courtesy call to the Vice Chancellor and participants during the 7th CBEC Forum

Day 5 and Day 6 (1st to 2nd June, 2024)

Field visit activities organized by the University of Liberal Arts of Bangladesh

This started with travel by bus from Dhaka to Pirganj and arriving in Annana hotel in the evening of 1st June 2024. The town where the hotel is located is a busy agricultural town and the temperatures are normally high requiring good room conditioning.

Market where Ananna hotel is located and popular with Litchi production

On 2nd June we started with a visit to a village in Pirganj area where there are cattle farmers (beneficiaries of Bangladesh Microfinance Project) which was arranged by Dr. Kader Muhammad and facilitated by Mr. Tafshirul Islam from ULAB Media Studies and an official from BRAC Bank. There were two cattle farming communities visited the with the first rearing local low yielding dairy cattle and second rearing high yielding dairy cattle and the third community were producing rice. The Chairlady of the community rearing local low yielding dairy cattle Ms Chandana who had dropped from school due to poverty had earlier been supported by the ULAB microfinance project led by Dr. Kader through purchase of two females which had each calved and therefore there was a total of 4 cattle. In the local low yielding dairy cattle rearing community it was observed that the condition of the animals was not very good as there was little supplementation with off farm feed sources like dairy meal and Napier grass. Consequently, the production per animal was low.

A member of the community preparing rice straw for hay heaping and the calves of the two granted dairy cows by ULAB microfinance

Due to low milk production most of the farmers in this community relied on small scale rice production and being involved in provision of farm labour at 600 Taka per day. It was noted that some women had borrowed money from Grameen Bank ranging from 10000 to 20000 Taka payable within 12 months (1 year) which was mainly used for family livelihood but not starting business. the earning from the community which ranged upto about 20000 Taka per month was used to repay the loan form Grameen bank and therefore there was no default of the repayment which was repaid at 10% and on reducing balance. This community was also observed to use cattle dung for making dung sticks used as fire wood and also had energy saving fire places, and also they conserved rice straw and corn stalks among others in form of cone shaped hay heaps.

The community and Ms Chandana the chairlady at the centre with Tafshirul, Zhou Deyi, Geofrey Gathungu, and a local ULAB history Professor

Innovative ways of using cattle dung as firewood, using energy saving cooking areas, and storage of hay in cone shaped heaps for use during off-season

The rice farming community had rice as the main enterprise and both men and women were involved in the production activities. Rice was planted by hand and harvesting was done manually using a sickle. There exists opportunity to introduce small scale rice planter and harvester by embracing microfinance and e-commerce to procure.

Rice harvesting activity at the ……community

Harvested rice tied into bands to allow manual threshing

The community keeping high yielding dairy cattle had very beautiful cows and they were supported by BRAC bank which gave them loans to purchase the animals and also they bought the milk from the farmers. The loans ranged from 250000 Taka and was used to strengthen the dairy enterprise. One dairy animal was producing upto 25-30 litres of milk per day. The cattle were also housed in well-constructed and maintained structures.

High yielding dairy cattle owned by the dairy farming community members

Similar to the earlier local low yielding dairy cattle rearing community, the high dairy cattle yielding community had energy saving cooking areas and they also conserved hay at a larger extent using the cone shaped heaps/piles.this community was also privileged to have one of their members being the area member of parliament Mr….. who had a farm of about 10 acres.

Energy saving cooking areas and big cone shaped hay heaps

Geofrey Gathungu, Zhou Deyi, Tashful Islam and Chen Zhilin with the MP in the middle front during the field visit

The field visit at Pirganj which took two days ended with a night bus trip at the midnight of 2nd June using a sleeper bus to Dhaka and then proceeded to Mymensingh city where Bangladesh Agricultural University (BAU) is located.

Bangladesh Agricultural University

Day 7 to Day 10 (3rd to 6th June, 2024)

The team consisting of Professor Zhou Deyi, Professor Geofrey Gathungu, Mr. Chen Zhilin and Mr. Li Gen arrived at BAU’s International Guest House from Dhaka using a taxi in the afternoon of 3rd June and was received by Prof. Salauddin Palash. After refreshments the team took a tour of the campus and they took dinner and other meals at the Pine and Dine Restaurant of BAU which is reserved for Lecturers. The team also visited Prof. Mohammad Jahangir Alam and took time to discuss the areas of possible collaboration in area of microfinance.

Meeting and later dinner with Prof. Mohammad Jahangir Alam

On 4th of June, the day started with seminar presentations whcich was chaired by the Dean of the Faculty of Agricultural Economics and Rural Sociology Professor Khandaker Md. Mostafizur Rahman. There were three presentations made as follows:

Professor Zhou Deyi gave an exciting presentation entiteled “Ecommerce logic, Chinese Ecommerce development and cooperation between China and B&R countries” there were highlights about the cost of production model which revealed that the production cost for most enterprises is 30% and the transaction cost is 70% and includes the transportation cost, product stock cost, shop staff, window-shopping, face-to-face negotiation, middlemen cost, shop rent and the information cost involves most aspects of the transaction costs (mainly stock cost). The traditional business model the products move from producers to a series of middlemen which inflates the costs. There is therefore need to embrace ecommerce which uses internet and can allow to reach nationwide or worldwide consumers. The benefits of e-commerce are bigger than the costs of e-commerce. An example can be drawn from the Chinese Rural E-commerce Development example the Alibaba, Shentong, Zhongtong, Yuantong, Baishihuitong, Yunda, Shunfeng among others. Internet influencers with multiple functions like providing public knowledge (quality and price), quality control, and collective bargaining to ease the decision-making for consumers. Therefore there exists huge opportunities to co-operate between China and Bangladesh.

Esrat Jahan a Lecturer in the Department of Agribusiness and Marketing, Bangladesh Agricultural University on behalf of Esrat Jahan, Md. Moniruzzaman, Dr. Sarah Yasmin and Abu Hayat Md. Saiful Islam also gave a presentation entitled “E-commerce and Consumers’ Satisfaction: Empirical evidence from Digital Marketing System of mango in Bangladesh” that highlighted on how farmers and traders can use ecommerce to reduce postharvest losses of mango. The presentation indicated that customer satisfaction, loyalty and trust are the key factors for long-term profitability, growth and sustainability of any business. Despite the rapid growth and popularity of the e-commerce, still this sector face difficulty in gaining customer satisfaction and trust particularly developing countries. Similarly, e-commerce in Bangladesh is an emerging sector and agro-based ecommerce is still young and expanded particularly during COVID pandemic. This study aimed to examine the digital marketing system of mango and factors influencing consumers’ satisfaction towards purchasing of mango through digital platform. A total of 145 consumers from all over the country, who have already purchased mango through digital platforms, and 60 digital mango sellers were selected from Rajshahi and Chapainawabganj districts by using a convenience sampling technique for the study. Data were collected from the consumers with the help of an e-questionnaire of Google Forms sent via email, Facebook, and Messenger. Face-to-face interviews and phone calls were applied to collect data from the digital sellers of mango to examine the digital marketing system of mango with the help of flow chart and descriptive statistics. Ordered logistic regression model was used to analyze the consumers’ satisfaction of purchasing mango through e-commerce. Producers were found as digital sellers in the study areas and digital consumers bought about 23 per cent mango from this type of mango producers. Buying from producers by digital sellers and selling it directly ecommerce to consumers was the most prominent channel. One fully digital mango marketing channel was found and that was producer-cum-digital seller to consumers and other channels are mixed marketing. Most of the sellers (99 percent) used courier service for transporting mango with plastic crate (98 percent) to consumers. About 83 percent digital sellers practiced grading of mango based on size and quality. Prior experience of online shopping, convenience shopping, quality of mango and quality of packaging are the positive and significant predictors of consumers’ satisfaction on mango ecommerce. It was observed that whereas, education had a significant negative impact on the consumers’ satisfaction. Consumers of the highest level of income group are more likely to be highly satisfied than those in the lower income groups. Prior experience of online shopping, convenience shopping, quality of mango, and quality of packaging has positive impact on the higher level of consumers’ satisfaction..

Further, professor Geofrey Gathungu also gave a presentation on microfinance progress in Kenya. He started by introducing Chuka University and stated it is a public university which was chartered in January 2013. The university is about 200 kilometres from Nairobi city and is located on the slopes of Mt. Kenya. The university has nine faculties including the Faculty of Agriculture, Faculty of Environmental Studies and Resources Development, Faculty of Science and Technology, Faculty of Humanities and Social Sciences, Faculty of Business Studies, Faculty of Education and Resources Development, School of Law and School of Nursing and Public Health. A highlight on the role microfinance can play in assisting small-scale farmers was done. The emphasis was that in Kenya agriculture is a key driver of poverty alleviation in form of providing employment, income generation, GDP growth, foreign exchange earnings, and food security. Smallholder farmers are crucial contributors to agricultural and economic development in developing countries hence their access to credit is a top priority where agriculture is the primary economic activity. However, agricultural productivity is lagging behind due to poor financing especially to the small-scale farmers. Microcredit provides opportunities for rural households to acquire agricultural inputs like seeds, fertilisers, post-harvesting technologies. Professor Geofrey Gathungu emphasized that there is need to support farmers through microfinance but there is need to adequately train the farmers and take advantage to understand them especially their areas of interest. A misdirected and hurried microfinance is a lost opportunity to uplift the farmers. This therefore calls for patience to understand the farmer priorities, preferences, and culture before committing with them in a microfinance project, Professor Geofrey Gathungu spelt out the lessons learnt while working with the farmers in fruit tree agroforestry initiatives which includes; working with and not for the farmer, collaboration between different stakeholders, using microfinance to buy farmers inputs like small agricultural machinery, understanding the farmers culture, involving the government to come up with favourable policies, having flexible microfinance repayment schedules and training the farmers to unlock their thinking among other things.

The seminar presentations at BAU attended by the visiting team and members of the faculty led by the Dean Faculty of Agricultural Economics and Rural Sociology Professor Khandaker Md. Mostafizur Rahman

Field activities at BAU

After the seminar on 4th of June, there was touring of university facilities which included;

Rice production: this was a BAU farm rice production enterprise. They were involved in rice seed production which was sold by the university to the Bangladesh Agricultural Development Unit for packaging and sale to farmers or the Bagladesh Institute of Nuclear Agriculture for further research as inbred lines. The rice enterprise department has various tools and equipments including planters, sprayers, combine harvester, thresher/cleaner among others that are used to increase on the efficiency of production.

Rice enterprise at BAU farm department

Livestock production enterprise: this enterprise has about 200 cattle put into different categories and units based on whether in production, dry, incalf or with calf, heifer or calves. All these are fed differently within their well-managed units. It was also observed that the livestock section has some buffaloes that are well tamed. The milk from the milked cows and buffalo is mixed. There was also a milk processing area and a laboratory and class room for graduate students in dairy science. The animals were fed with both fodder grass, hay and concentrates.

Beef cattle, buffaloes, newly calved dairy cattle, and 8 month old heifers in the livestock unit

With BAU staff in the livestock/dairy unit

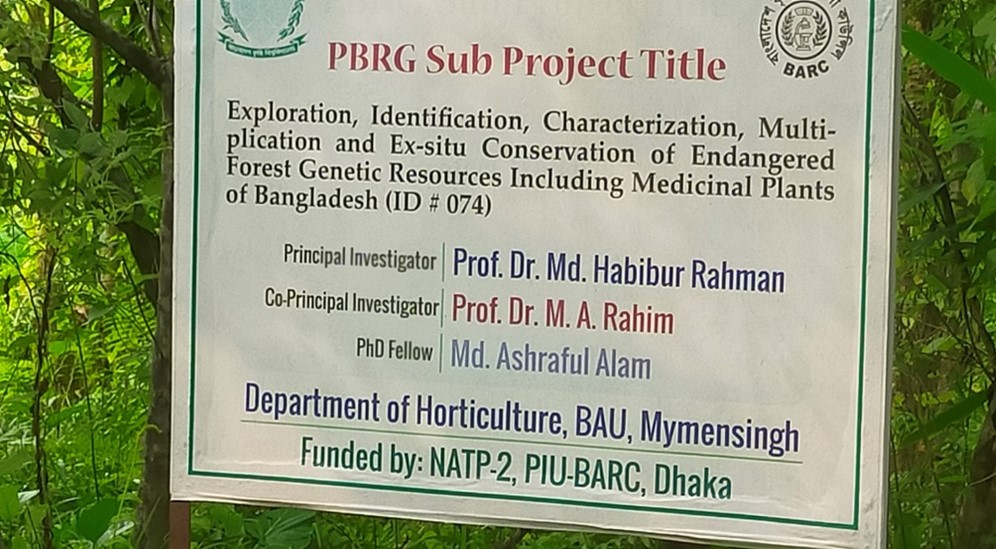

Visit to Germplasm center: This is a centre which houses most of the fruit trees, forest and medicinal plants. There were over 350 varieities of mango, more than 30 Litchi (Lychee) fruit, avocado, quava, citrus, dragon fruit, grapes among others. The trees are collected from different parts of the world to conserve the germplasm.

Two key projects being implemented at the germplasm centre

Visit to livestock farming communities: two livestock farmers were visited and they had beef and dairy cattle. the beef cattle were kept and fattened in preparation for the Muslim festival to be held on 17th of June. The farmers were also doing rice production and one of the farmer had stored rice to wait for better market prices. One of the farmer also kept antelopes and sheep above the beef cattle.

Beef cattle, stored rice, antelopes and goats in the livestock farmig communities

Visit to the Agricultural Extension Department: There was a visit to the Department of Agricultural Extension Education which works closely with the farmers involved in both crop and livestock production. The team was received by the Director of Extension Professor Mohammed Nasir Uddin and the extension team who took us to the field to understand their activities. There was a visit to a women group keeping livestock and they had interest in microfinance for mushroom production.

Visit to the fabrication lab/ agri. machinery lab: Fabrication of different agricultural machinery was done in the Department of Farm Power and Machinery. The team was received in the department by Professor Chayan Kumer Saha and was taken through the postharvest loss reduction innovation laboratory. There were different fabrications mainly dryers to dry cereals and vegetables like eggplant, onions among others in smallscale and also other small agricultural machineries like harvester were noted. A cooler being used for smallscale cooling was observed and there were mangoes which had been in storage for 3 months. The department also had cutters including 3D for designing e.g. door names, cups, key holders among others. A solar based irrigation system was also noticeable and these activities had received external funding e.g. from Feed the Future.

Solar based irrigation section used to demonstrate vegetable production

Fabricated dryers for drying cereals and vegetables to minimize postharvest losses

Visit to Grameen Bank: The team visited grameen bank a microcredit organization started in 1976 as a pilot research group in “Jobra” village in Chattogram district of Bangladesh and . t was transformed into a bank in 1983 with the aim of alleviating poverty and empowering the women in Bangladesh through micro-credit. During the visit the team received testimony from members and one of the loanee started with borrowing 10,000BDT and at the time of the visit a loan of 300000 BDT was being processed for her. The bank gives loan at 10% per annum on reducing balance. The highest loanee had received 1,500,000BDT. Farmers were using the loan to strengthen farming including purchase of small agricultural machines like thresher. The members also benefited from scholarship and stipend for their children in college. It was noted that all banking transactions except loan disbursement are done in the meetings of the borrowers at the village level centers organized by the center managers. Their loan evaluation involves visiting the members on the ground to access them but they must be recommended by other group members to be able to be considered for the microcredit.

Exploration of the cattle market in Mymensingh City

There was an open market where there was sale of different types of livestock especially cattle. a lot of animals were available in the market from different parts of Mymensingh.

Livestock market in Mymensing where there is open sale of livestock mainly cattle, sheep and goats

The activities in BAU ended on 6th June when the team left for Dhaka where they visited Star Telcom a phone accessories company that imports these accessories from china under their brand name “STAR” and then sells throughout Bangladesh. They also do money exchange from Chinese Yen to Bangladesh Taka.

Day 11 to Day 13 (7th to 9th June, 2024)

Exploration of the Chittagong city

On 7th June using the Bangladesh railway transport the team left for Chittangong city and arrived in the afternoon and explored the city and the beach. On 8th June they were able to visit the Central Export Processing Zone (CEPZ), and had a view of the Chittangong port. It was observed that there was a lot of processing companies in the CEPZ which is closer to the port which they used to transport such products to other parts of the world. The CEPZ probably enabled such companied to reduce the transaction cost due to transportation.

During travel to and exploration of the Chittangong city, the beach, CEPZ, and Chittangong port

The team left the Chittangong port city on the morning of 9th June to Dhaka. They then started departing back to their respective countries on 10th June. The CBEC workshop provided a good opportunity for networking and sharing information on microfinance, application of e-commerce, and the need for strengthening update of microfinance through farmer training.

Leave a comment